Insurance for Stainless Steel Fabricators

Insurance for Stainless Steel Fabricators

Comprehensive Protection for Stainless Steel Fabrication Businesses

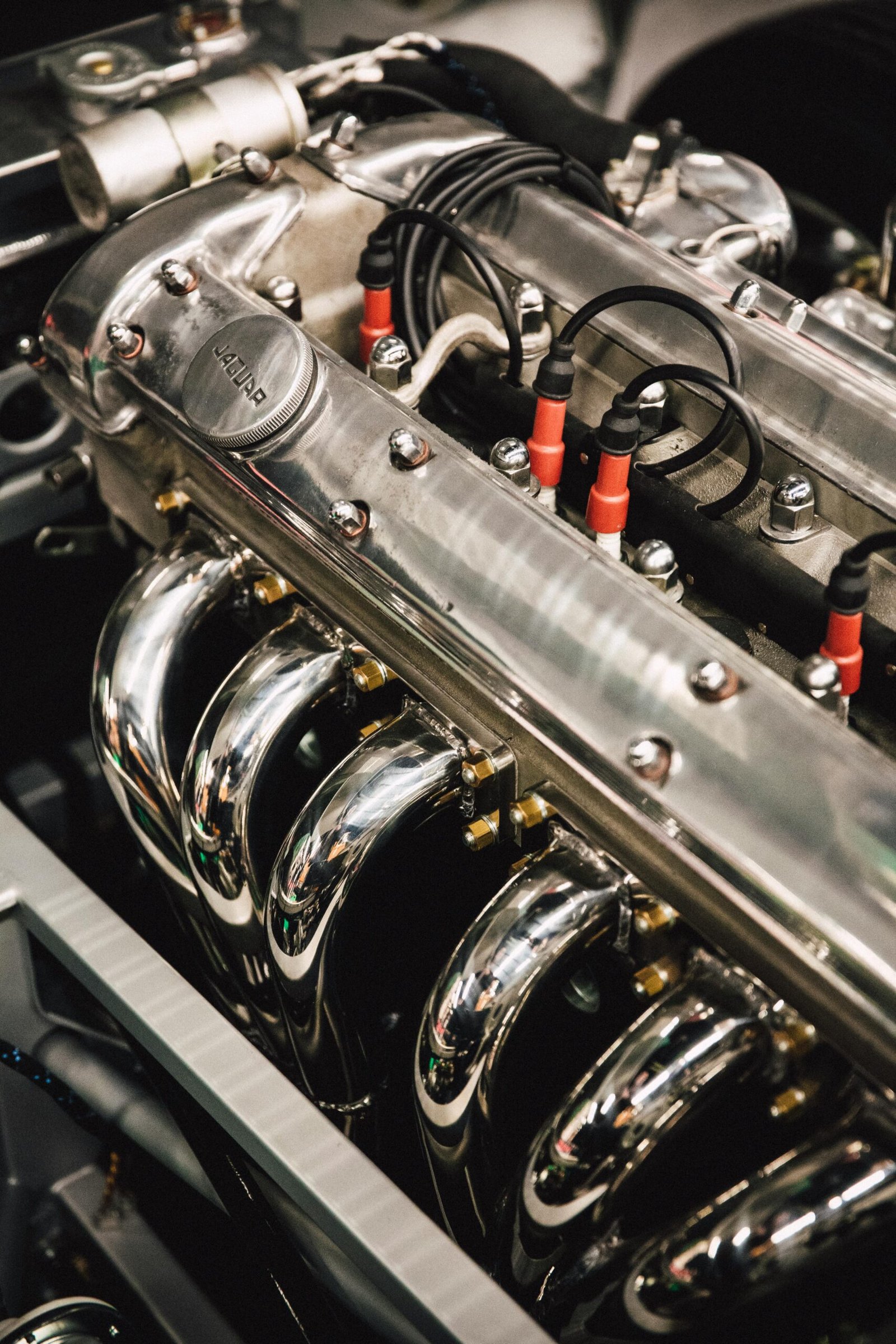

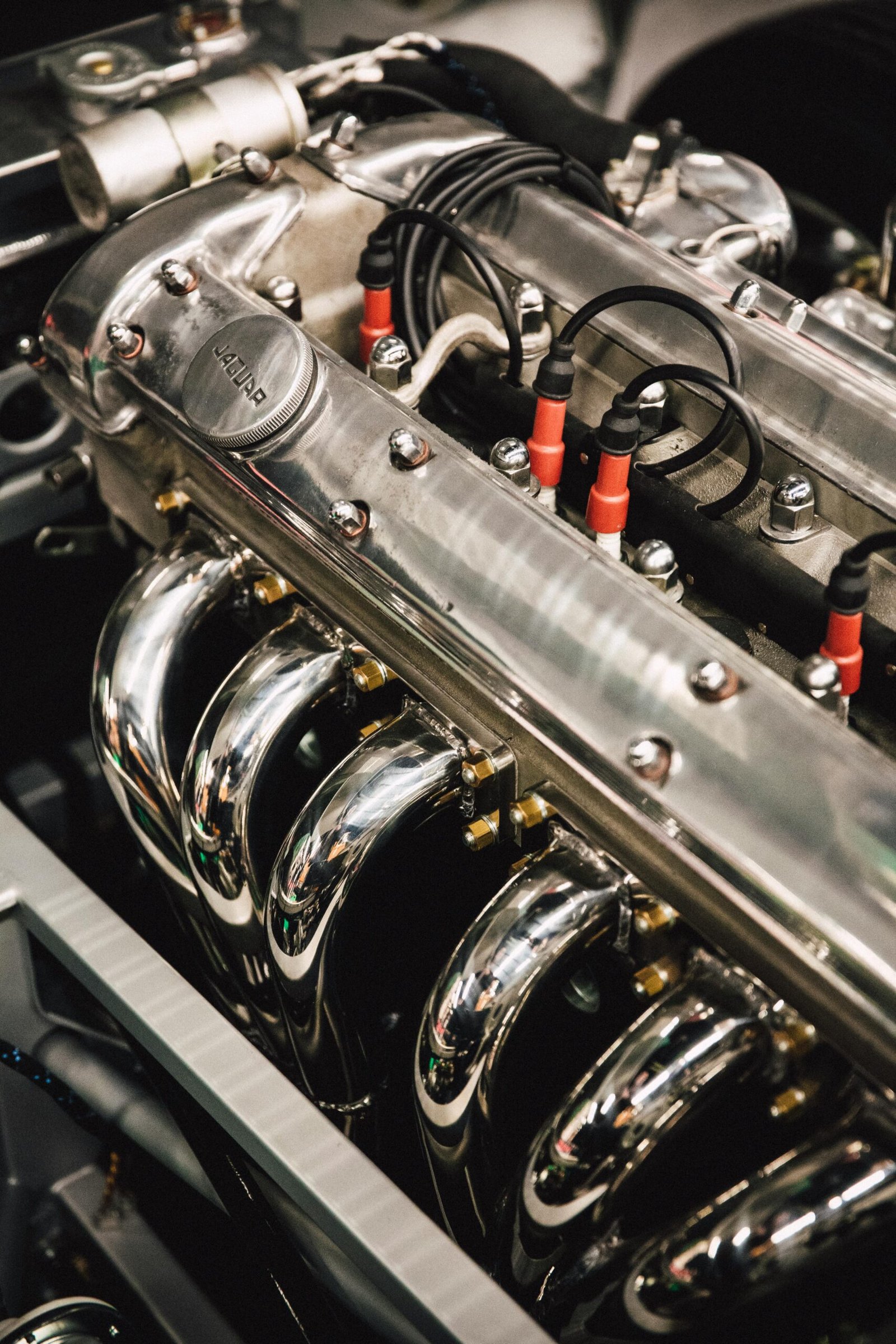

Stainless steel fabrication is a cornerstone of modern construction, manufacturing, and custom metal design. From precision welding and cutting to large-scale structural assembly, stainless steel fabricators handle complex operations that require heavy equipment, skilled labor, and constant attention to detail. At Metal Shop Insurance, we understand the risks that come with running a stainless steel fabrication shop — from property damage and employee injuries to equipment breakdowns and client liability claims.

Our goal is to provide complete, customized insurance coverage for stainless steel fabrication businesses across California. Whether you specialize in architectural metalwork, industrial components, or food-grade stainless steel fabrication, we design insurance policies that protect your assets, minimize downtime, and help your business thrive under any circumstance.

By partnering with top-rated insurance carriers and leveraging our deep knowledge of the metal and industrial sectors, we ensure that your coverage is not only compliant but optimized for your unique operation.

Insurance for Stainless Steel Fabricators

Comprehensive Protection for Stainless Steel Fabrication Businesses

Stainless steel fabrication is a cornerstone of modern construction, manufacturing, and custom metal design. From precision welding and cutting to large-scale structural assembly, stainless steel fabricators handle complex operations that require heavy equipment, skilled labor, and constant attention to detail. At Metal Shop Insurance, we understand the risks that come with running a stainless steel fabrication shop — from property damage and employee injuries to equipment breakdowns and client liability claims.

Our goal is to provide complete, customized insurance coverage for stainless steel fabrication businesses across California. Whether you specialize in architectural metalwork, industrial components, or food-grade stainless steel fabrication, we design insurance policies that protect your assets, minimize downtime, and help your business thrive under any circumstance.

By partnering with top-rated insurance carriers and leveraging our deep knowledge of the metal and industrial sectors, we ensure that your coverage is not only compliant but optimized for your unique operation.

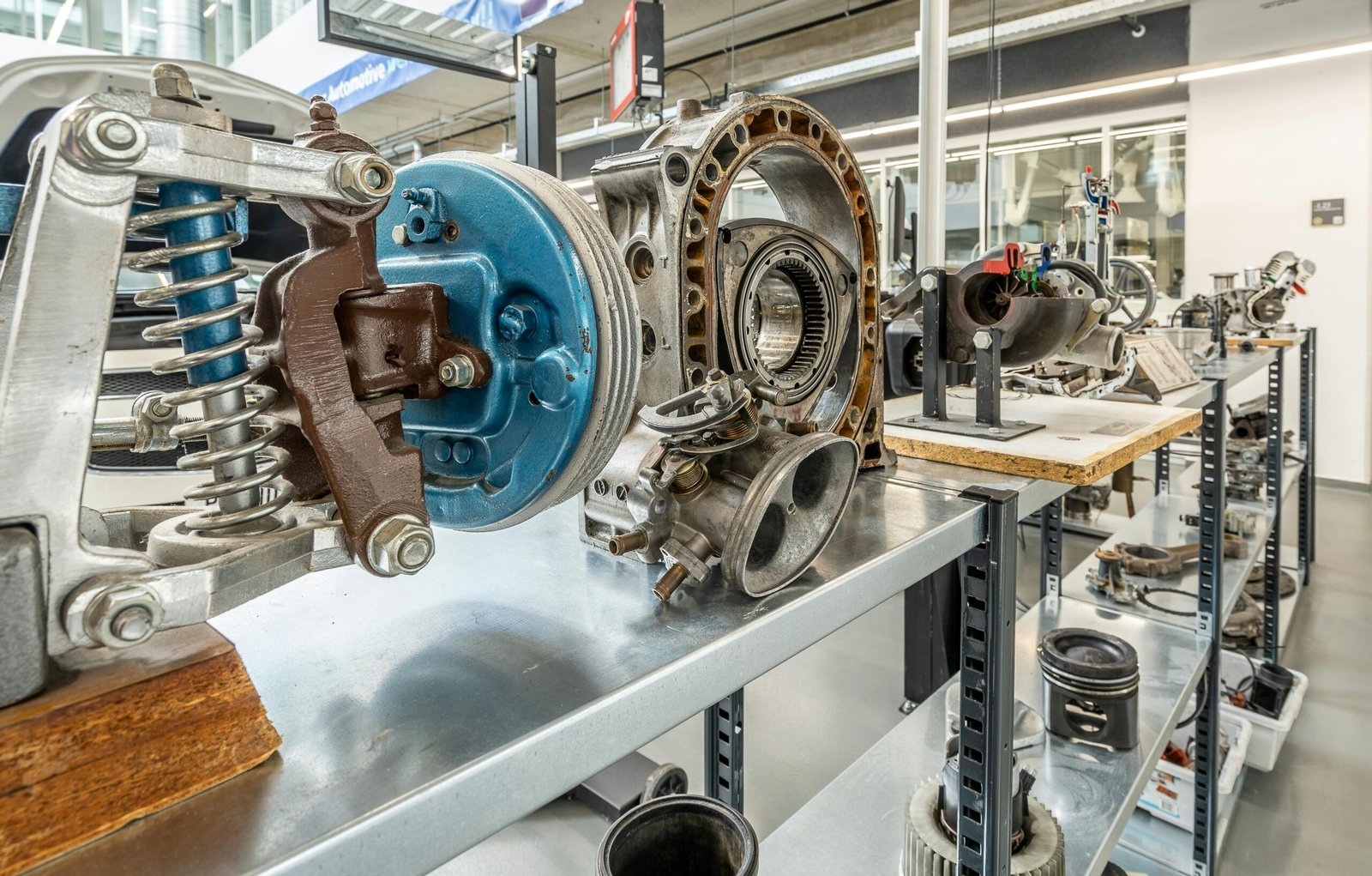

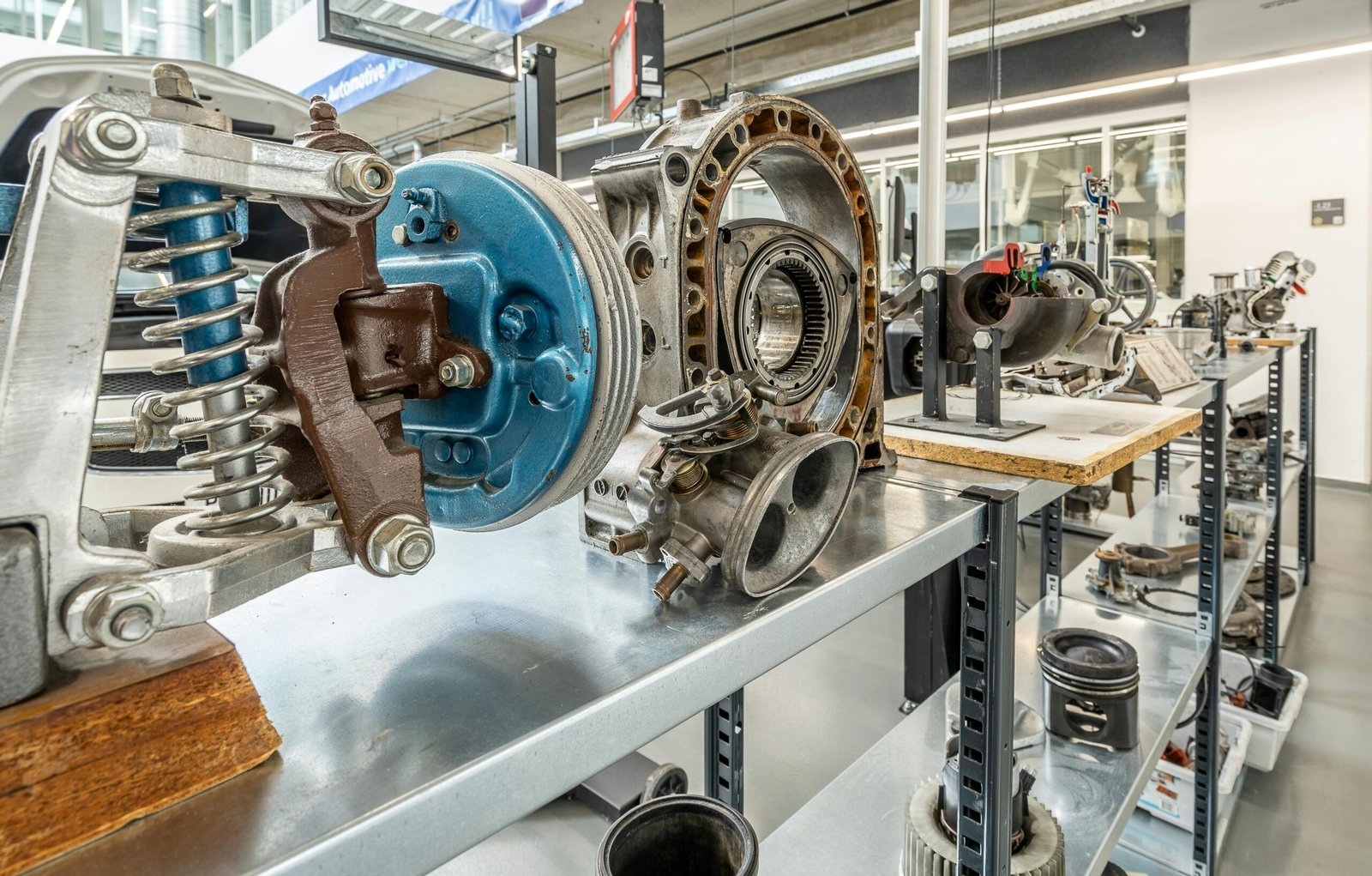

Understanding the Risks in Stainless Steel Fabrication

Fabricating stainless steel is both an art and a science — requiring advanced machinery, high temperatures, and skilled technicians to produce strong, corrosion-resistant components. But behind every weld, polish, and cut lies potential risk. Sparks can cause fires, grinding can lead to employee injuries, and defective materials or design errors can result in costly product liability claims.

Additionally, stainless steel fabricators often face risks such as:

Machinery failure or electrical malfunctions halting production

Theft or damage to expensive materials and custom components

Employee injuries from welding fumes, cuts, or repetitive strain

Client disputes due to delivery delays or product imperfections

Equipment transport risks between worksites or client facilities

At Metal Shop Insurance, we create policies that help stainless steel shops handle these exposures confidently. From your first quote to claims assistance, our team ensures your business remains covered, compliant, and protected from every angle.

Understanding the Risks in Stainless Steel Fabrication

Fabricating stainless steel is both an art and a science — requiring advanced machinery, high temperatures, and skilled technicians to produce strong, corrosion-resistant components. But behind every weld, polish, and cut lies potential risk. Sparks can cause fires, grinding can lead to employee injuries, and defective materials or design errors can result in costly product liability claims.

Additionally, stainless steel fabricators often face risks such as:

Machinery failure or electrical malfunctions halting production

Theft or damage to expensive materials and custom components

Employee injuries from welding fumes, cuts, or repetitive strain

Client disputes due to delivery delays or product imperfections

Equipment transport risks between worksites or client facilities

At Metal Shop Insurance, we create policies that help stainless steel shops handle these exposures confidently. From your first quote to claims assistance, our team ensures your business remains covered, compliant, and protected from every angle.

Essential Coverage Options for Stainless Steel Fabricators

Your stainless steel fabrication business deserves specialized protection designed for the precision and demands of your industry. That’s why Metal Shop Insurance offers a complete suite of commercial insurance options customized for California fabricators:

General Liability Insurance – Protects against third-party injuries, property damage, or client claims that occur at your shop or job site.

Commercial Property Insurance – Covers your fabrication facility, welding machines, lathes, grinders, and materials against losses caused by fire, theft, or natural disasters.

Workers’ Compensation Insurance – Provides coverage for employee injuries, medical expenses, and lost wages due to work-related accidents.

Product Liability Insurance – Protects your business if a fabricated stainless steel component fails or causes damage after installation.

Equipment Breakdown Insurance – Covers repair or replacement costs for essential machinery and electrical systems.

Inland Marine Insurance – Covers tools, materials, and finished products while being transported or stored off-site.

Business Owner’s Policy (BOP) – Combines property, liability, and business interruption protection into one cost-effective package.

Commercial Auto Insurance – Protects vehicles used for transporting materials, products, or equipment between clients or sites.

Every fabrication operation is unique. That’s why our specialists review your processes, materials, and risk exposure to create a policy built around your workflow and budget — not a one-size-fits-all plan.

Essential Coverage Options for Stainless Steel Fabricators

Your stainless steel fabrication business deserves specialized protection designed for the precision and demands of your industry. That’s why Metal Shop Insurance offers a complete suite of commercial insurance options customized for California fabricators:

General Liability Insurance – Protects against third-party injuries, property damage, or client claims that occur at your shop or job site.

Commercial Property Insurance – Covers your fabrication facility, welding machines, lathes, grinders, and materials against losses caused by fire, theft, or natural disasters.

Workers’ Compensation Insurance – Provides coverage for employee injuries, medical expenses, and lost wages due to work-related accidents.

Product Liability Insurance – Protects your business if a fabricated stainless steel component fails or causes damage after installation.

Equipment Breakdown Insurance – Covers repair or replacement costs for essential machinery and electrical systems.

Inland Marine Insurance – Covers tools, materials, and finished products while being transported or stored off-site.

Business Owner’s Policy (BOP) – Combines property, liability, and business interruption protection into one cost-effective package.

Commercial Auto Insurance – Protects vehicles used for transporting materials, products, or equipment between clients or sites.

Every fabrication operation is unique. That’s why our specialists review your processes, materials, and risk exposure to create a policy built around your workflow and budget — not a one-size-fits-all plan.

Why Stainless Steel Fabricators Trust Metal Shop Insurance

At Metal Shop Insurance, we know that your business success depends on precision, safety, and reliability. Our mission is to deliver insurance solutions that reflect those same values. We’ve built long-term relationships with stainless steel fabricators throughout California by offering expert guidance, transparent coverage options, and responsive service when it matters most.

We help you stay compliant with California state insurance laws, OSHA standards, and industry-specific requirements, ensuring that your shop meets safety expectations and protects its workforce effectively.

When accidents happen, we don’t just process claims — we act as your advocate, helping you recover faster and return to business with minimal interruption. With our deep understanding of fabrication operations, we anticipate potential risks before they turn into financial losses, giving you confidence to grow your shop without worrying about what could go wrong.

At Metal Shop Insurance, your craft is precision — and our craft is protection.

Why Stainless Steel Fabricators Trust Metal Shop Insurance

At Metal Shop Insurance, we know that your business success depends on precision, safety, and reliability. Our mission is to deliver insurance solutions that reflect those same values. We’ve built long-term relationships with stainless steel fabricators throughout California by offering expert guidance, transparent coverage options, and responsive service when it matters most.

We help you stay compliant with California state insurance laws, OSHA standards, and industry-specific requirements, ensuring that your shop meets safety expectations and protects its workforce effectively.

When accidents happen, we don’t just process claims — we act as your advocate, helping you recover faster and return to business with minimal interruption. With our deep understanding of fabrication operations, we anticipate potential risks before they turn into financial losses, giving you confidence to grow your shop without worrying about what could go wrong.

At Metal Shop Insurance, your craft is precision — and our craft is protection.

- FAQs

Common Insurance Questions for Metal & Manufacturing Businesses

Most fabricators need general liability, commercial property, workers’ compensation, and product liability insurance to protect against injuries, equipment damage, and product-related risks.

Yes, our commercial property and equipment breakdown insurance can cover your specialized machinery and tools against fire, theft, and operational failures.

Absolutely. Inland Marine Insurance extends coverage to tools, materials, and finished components while being transported or used off-site at customer locations.

We assess your shop’s operations, materials, and project types to design a policy that aligns with your actual risks — providing comprehensive protection without unnecessary extras.