Insurance for Industrial Equipment Fabrication

Insurance for Industrial Equipment Fabrication

Protecting California’s Industrial Equipment Fabricators from Costly Risks

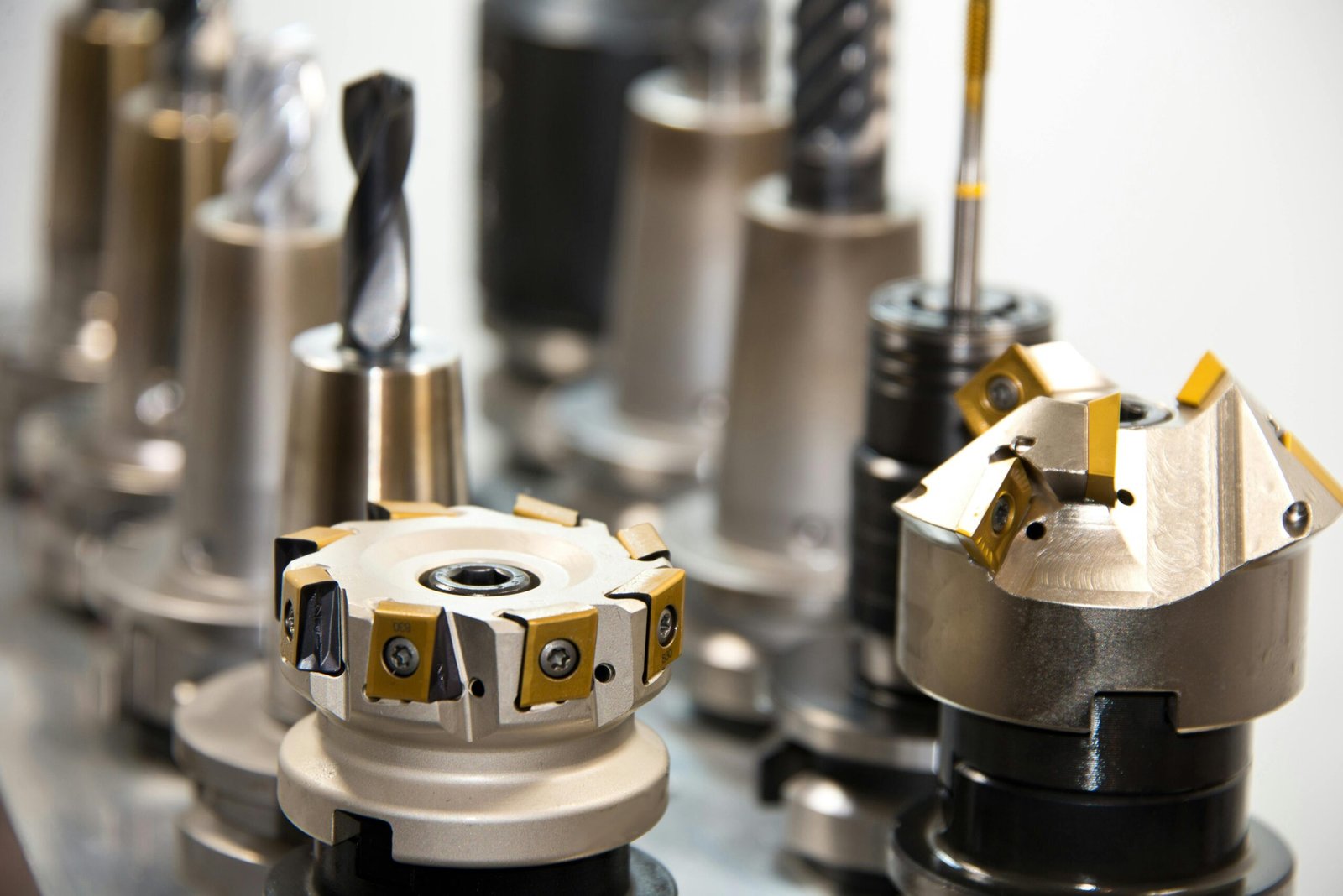

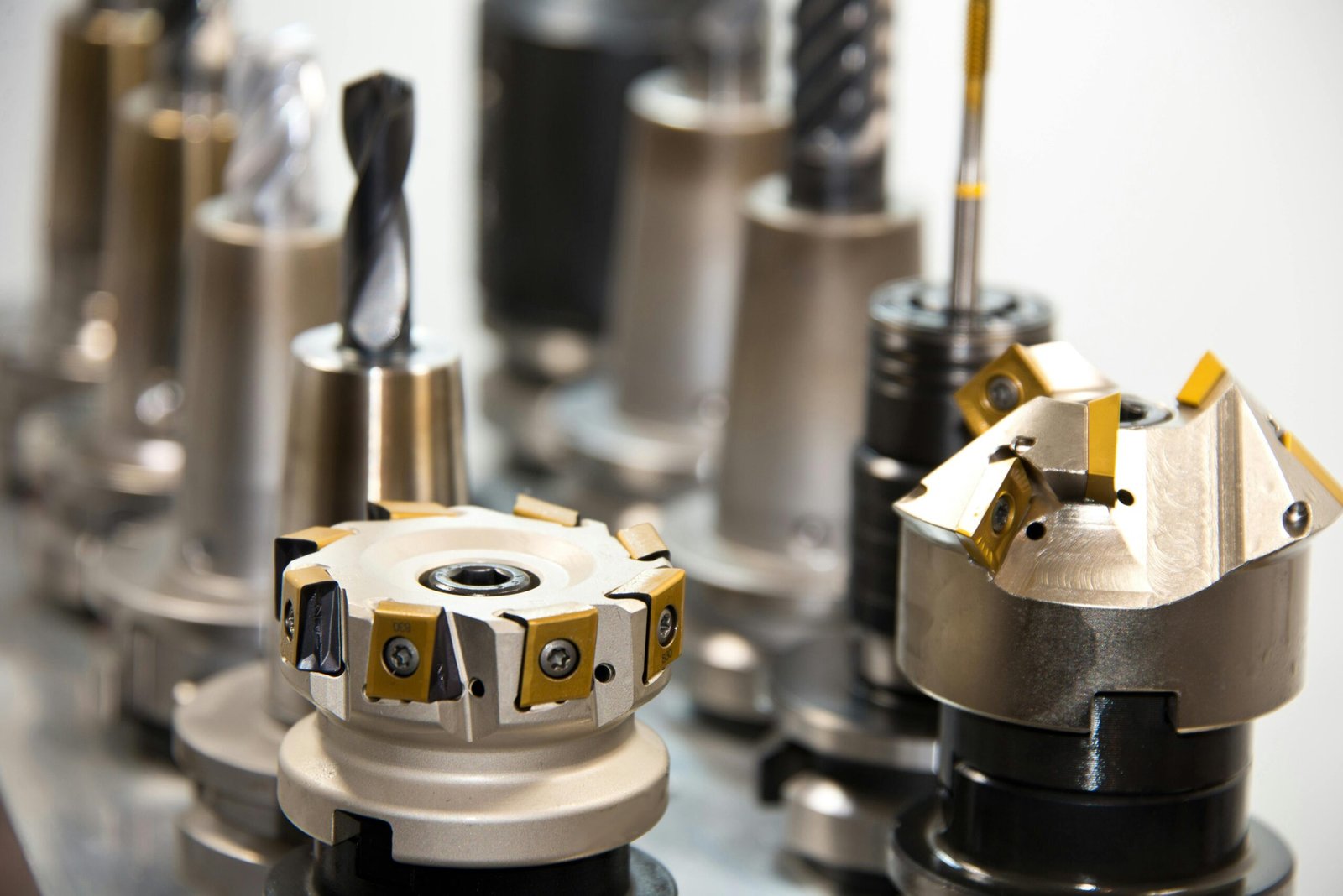

Industrial equipment fabrication forms the backbone of California’s manufacturing and construction industries. Whether your business builds cranes, conveyors, pressure vessels, or custom machinery, your operations rely on precision engineering, skilled labor, and expensive equipment.

But with high-value projects come high risks — from workplace injuries and fires to machinery breakdowns and liability claims from clients. Metal Shop Insurance provides specialized insurance for industrial equipment fabricators designed to safeguard your facilities, workforce, and products from unforeseen losses.

We understand the unique challenges that come with fabricating large, complex equipment. Your work often involves welding, machining, assembly, and testing heavy components — all of which expose your business to potential property damage, product defects, and operational downtime. Our insurance experts tailor coverage that keeps your production line protected and your business fully compliant with California’s safety and insurance regulations.

Insurance for Industrial Equipment Fabrication

Protecting California’s Industrial Equipment Fabricators from Costly Risks

Industrial equipment fabrication forms the backbone of California’s manufacturing and construction industries. Whether your business builds cranes, conveyors, pressure vessels, or custom machinery, your operations rely on precision engineering, skilled labor, and expensive equipment.

But with high-value projects come high risks — from workplace injuries and fires to machinery breakdowns and liability claims from clients. Metal Shop Insurance provides specialized insurance for industrial equipment fabricators designed to safeguard your facilities, workforce, and products from unforeseen losses.

We understand the unique challenges that come with fabricating large, complex equipment. Your work often involves welding, machining, assembly, and testing heavy components — all of which expose your business to potential property damage, product defects, and operational downtime. Our insurance experts tailor coverage that keeps your production line protected and your business fully compliant with California’s safety and insurance regulations.

Understanding the Risks in Industrial Equipment Fabrication

Industrial equipment fabrication carries significant operational and financial exposures. These businesses handle expensive materials, high-temperature welding, complex designs, and strict client specifications — leaving little room for error.

Common risks include:

Fire and explosion hazards from welding, grinding, and fuel storage.

Employee injuries caused by cranes, forklifts, or assembly line machinery.

Equipment breakdowns that halt production or delay client deliveries.

Defective product liability if fabricated machinery fails after installation.

Damage during testing or transportation of large equipment.

Environmental or pollution risks from paints, solvents, and coatings.

Cyber risks involving stolen designs, client data, or control system breaches.

At Metal Shop Insurance, we work to identify your specific exposures and provide tailored coverage that ensures you’re prepared for every challenge — from daily operations to long-term client contracts.

Understanding the Risks in Industrial Equipment Fabrication

Industrial equipment fabrication carries significant operational and financial exposures. These businesses handle expensive materials, high-temperature welding, complex designs, and strict client specifications — leaving little room for error.

Common risks include:

Fire and explosion hazards from welding, grinding, and fuel storage.

Employee injuries caused by cranes, forklifts, or assembly line machinery.

Equipment breakdowns that halt production or delay client deliveries.

Defective product liability if fabricated machinery fails after installation.

Damage during testing or transportation of large equipment.

Environmental or pollution risks from paints, solvents, and coatings.

Cyber risks involving stolen designs, client data, or control system breaches.

At Metal Shop Insurance, we work to identify your specific exposures and provide tailored coverage that ensures you’re prepared for every challenge — from daily operations to long-term client contracts.

Comprehensive Insurance Coverage for Industrial Equipment Fabricators

Whether you fabricate machinery for construction, energy, or manufacturing clients, Metal Shop Insurance provides a full suite of policies that protect your people, property, and products.

Recommended coverages include:

General Liability Insurance – Protects your business from claims of third-party injury, property damage, or defective fabrication work.

Commercial Property Insurance – Covers your workshop, tools, cranes, and materials from fire, theft, or natural disasters.

Workers’ Compensation Insurance – Provides required medical and wage benefits to injured employees in California.

Equipment Breakdown Insurance – Covers costly repairs or replacements for essential machinery used in fabrication and testing.

Product Liability Insurance – Protects you from lawsuits if fabricated parts or machines fail or cause damage after sale.

Commercial Auto Insurance – Covers company vehicles used to transport heavy machinery or materials.

Inland Marine Insurance – Insures mobile tools, components, and fabricated parts during transit or at offsite locations.

Business Interruption Insurance – Reimburses income lost during covered shutdowns caused by fire, equipment failure, or other insured events.

Umbrella & Excess Liability Insurance – Provides extra coverage limits for large contracts or high-value client work.

Cyber Liability Insurance – Protects your company against cyberattacks, data theft, or system breaches impacting designs or client communication.

These coverages ensure that your operation — whether a small custom fabrication shop or a large industrial manufacturer — is fully protected against both expected and unexpected losses.

Comprehensive Insurance Coverage for Industrial Equipment Fabricators

Whether you fabricate machinery for construction, energy, or manufacturing clients, Metal Shop Insurance provides a full suite of policies that protect your people, property, and products.

Recommended coverages include:

General Liability Insurance – Protects your business from claims of third-party injury, property damage, or defective fabrication work.

Commercial Property Insurance – Covers your workshop, tools, cranes, and materials from fire, theft, or natural disasters.

Workers’ Compensation Insurance – Provides required medical and wage benefits to injured employees in California.

Equipment Breakdown Insurance – Covers costly repairs or replacements for essential machinery used in fabrication and testing.

Product Liability Insurance – Protects you from lawsuits if fabricated parts or machines fail or cause damage after sale.

Commercial Auto Insurance – Covers company vehicles used to transport heavy machinery or materials.

Inland Marine Insurance – Insures mobile tools, components, and fabricated parts during transit or at offsite locations.

Business Interruption Insurance – Reimburses income lost during covered shutdowns caused by fire, equipment failure, or other insured events.

Umbrella & Excess Liability Insurance – Provides extra coverage limits for large contracts or high-value client work.

Cyber Liability Insurance – Protects your company against cyberattacks, data theft, or system breaches impacting designs or client communication.

These coverages ensure that your operation — whether a small custom fabrication shop or a large industrial manufacturer — is fully protected against both expected and unexpected losses.

Why Choose Metal Shop Insurance for Industrial Equipment Fabrication

At Metal Shop Insurance, we specialize in protecting California’s metal and industrial trades. Our team knows the exact risks your business faces and crafts coverage that fits your equipment, contracts, and compliance needs.

Why fabricators trust us:

Industry Expertise: We know the fabrication industry — from OSHA compliance to WCIRB classifications.

Tailored Solutions: Every policy is built around your specific equipment, job scope, and project scale.

Fast COIs & Documentation: We deliver certificates of insurance quickly so you can bid, build, and deliver without delay.

Responsive Claims Handling: Our dedicated claims team minimizes downtime and helps you recover faster.

Comprehensive Protection: From workers’ safety to client liability, every part of your business is covered.

Choosing Metal Shop Insurance means gaining a partner that understands the industrial world — and ensures your fabrication business stays strong, compliant, and financially secure.

Why Choose Metal Shop Insurance for Industrial Equipment Fabrication

At Metal Shop Insurance, we specialize in protecting California’s metal and industrial trades. Our team knows the exact risks your business faces and crafts coverage that fits your equipment, contracts, and compliance needs.

Why fabricators trust us:

Industry Expertise: We know the fabrication industry — from OSHA compliance to WCIRB classifications.

Tailored Solutions: Every policy is built around your specific equipment, job scope, and project scale.

Fast COIs & Documentation: We deliver certificates of insurance quickly so you can bid, build, and deliver without delay.

Responsive Claims Handling: Our dedicated claims team minimizes downtime and helps you recover faster.

Comprehensive Protection: From workers’ safety to client liability, every part of your business is covered.

Choosing Metal Shop Insurance means gaining a partner that understands the industrial world — and ensures your fabrication business stays strong, compliant, and financially secure.

- FAQs

Common Insurance Questions for Metal & Manufacturing Businesses

Most businesses need general liability, property, workers’ compensation, and product liability insurance. Additional coverages like equipment breakdown or business interruption are highly recommended.

Yes. Inland marine insurance covers machinery, materials, or finished products that are damaged or lost in transit or at offsite project locations.

Product liability and completed operations coverage protect your business from claims of defective or failed machinery after installation or delivery.

Yes. Any business with employees in California must carry workers’ compensation insurance to comply with state regulations and protect workers.